Prop firm reviews can sound like they’re talking about two different companies. One trader shares a smooth payout, another gets denied after a rules check, and both can be true. That’s why a GFunded prop firm review only helps if you read it next to the rules, not the hype.

GFunded launched in 2021 and sells access to funded-style accounts after an evaluation (or via Instant Funding). The headline offers are easy to spot, account sizes often run from $10,000 to $200,000, profit splits can climb as high as 85% on some paths, scaling can reach into seven figures (often promoted up to $6.4M), and you can usually pick from TradeLocker, DXTrade, or Match Trader.

The real risk sits in the math and the fine print. Traders commonly trip on drawdown limits (often around a 4% daily loss and 6% max loss) and the details behind trailing vs static drawdown, plus payout rules like minimum trading days, consistency metrics, and KYC reviews. Add-ons and resets can also change the true cost after checkout.

This guide breaks down rules, fees, platforms, and payouts in plain English. It’s not financial advice, details can change by plan and region, and most trading happens on simulated accounts that can still pay real money.

When you pay GFunded, you’re not buying a “funded broker account” in the normal sense. You’re buying a rules-based trading program: pay a one-time fee (evaluation or Instant Funding), trade inside strict loss limits, then earn a share of profits if you follow the terms.

That’s why reviews feel split. If you respect the rules and your trades look clean, the experience can feel simple. If you miss one detail (drawdown math, minimum trading days, payout checks), it can feel harsh. The “product” is the rule set and how it’s enforced, not a promise that you’ll get paid just because you traded well.

GFunded (like most retail prop firms) runs the challenge in a simulated account. Prices move like a normal market feed, you place trades on their supported platform, and your PnL updates in real time. The difference is your orders aren’t routed to a live brokerage account under your name during the evaluation.

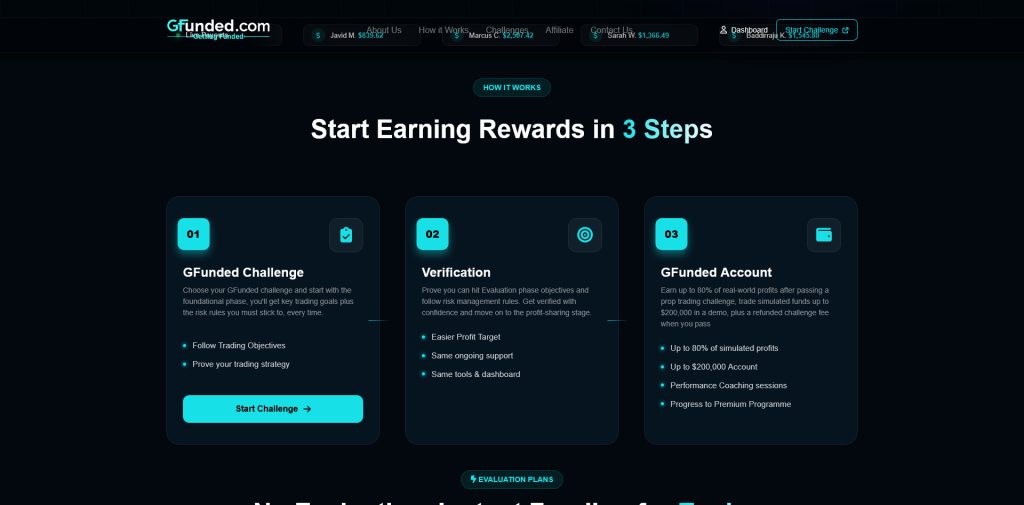

There are usually two big stages:

A sim can pay out because the firm isn’t paying you from “your trades hitting the market.” It’s paying you based on your performance under its program terms. That’s also why the details still matter a lot:

Simple example: you buy an evaluation, trade for the required number of days, and reach the profit target without breaking drawdown rules. You move to the funded stage, build profit again, then request a payout inside the dashboard. Your request gets reviewed (rules, trade behavior, KYC), and if it checks out, you receive your share.

A few basics clear up most confusion fast:

Also keep expectations grounded: prop firms are usually not regulated like brokers. That doesn’t mean they’re automatically bad, it means you need to verify more yourself.

Before you spend a dollar, treat this like a small due diligence project. The goal is to avoid surprises later, when you’re close to passing or requesting a payout.

Here’s the short checklist that prevents most headaches:

Big scaling numbers sound exciting, but clear terms and consistent enforcement matter more when real money leaves the building.

With GFunded-style prop rules, you can be “right” on direction and still fail the account. The most common blow ups come from simple math: profit targets, daily loss caps, max loss caps, and how drawdown is calculated (balance vs equity, trailing vs static). If you treat the rules like a risk box you must trade inside, your strategy gets a fair shot. If you trade like it’s your personal account, the limits will feel unforgiving.

Most evaluation models revolve around a clear profit objective. Traders commonly see targets in the 6% to 15% range across the industry, and GFunded discussions often center on a 10% profit target for a 1-step style evaluation (some 2-step paths are split, such as 8% then 5%, depending on the plan).

The “no time limit” pitch sounds relaxing, but it doesn’t remove pressure. It just changes it. Instead of racing a 30-day clock, you’re managing two other forces:

Minimum trading days are there to prove repeatability. Many firms count any day with at least one trade as a “trading day” (even a tiny position), while some require a minimum profit for the day to count. Either way, the message is the same: passing should look like a plan, not a lottery ticket.

A realistic pacing example (using the common numbers traders mention):

If you try to “just get it done” in two days, you’ll usually increase size, take lower-quality setups, and flirt with the daily cap. A calmer pace looks like this: aim for 0.5% to 1% on good days, accept flat days, and stretch the attempt over 10 to 25 trading days. You still finish with no time stress, and you keep plenty of room under the daily loss line if you hit a rough session.

These two limits sound similar, but they behave differently.

Daily loss limit is your “one-day floor.” If you hit it, you fail even if the next trade would have been a winner. Many GFunded summaries cite daily limits around 4% (some plans vary). The daily limit typically resets at the firm’s server “day change,” often midnight server time.

Max loss limit (max drawdown) is your “account floor.” It’s the total loss allowed across the life of the account. Many rule summaries mention around 6% for this figure (again, plan-dependent).

Here’s the part that surprises people: intraday swings can trigger a daily breach even if the trade later recovers. This is most painful when the daily limit is based on equity (open profit and loss) instead of balance (closed trades only).

Simple scenario:

Even if price comes back and you later close green, the system may mark that dip as a daily loss breach. That’s why position sizing and stop placement matter more than being “right.” A clean way to stay safe is to size so a normal stop-out is boring, and so two losses in a row don’t put you at the edge of the daily line.

This is where many “I was profitable and still failed” stories come from.

Static drawdown stays fixed. If max loss is 6% on a $100,000 account, your floor is $94,000, and it doesn’t move.

Trailing drawdown moves up as your account hits new highs. The limit can rise when your equity makes a new peak, but it usually doesn’t move back down when your profits fade. Some trailing systems also “lock” at certain points (for example, once you’ve built enough profit, the floor may stop trailing and sit at a safer level). You must read the plan’s exact wording.

Trailing drawdown gets extra risky when it’s equity-based, because a quick floating profit spike can pull the floor up, then a fast reversal can push you into breach. Volatility and overnight gaps make this worse because price can jump past your stop before you can react.

Concrete example:

Now you’re “up,” but you’ve lost breathing room. If the market reverses and your equity drops to $99,900, you breach, even though you’re basically back near where you started. That’s the trailing trap: profits raise the floor, then normal pullbacks can break it. The fix is not complicated, but it takes discipline: reduce size as you climb, take partials, and avoid holding oversized positions into volatile sessions or overnight if your plan’s drawdown is equity-based.

Most account failures are still drawdown-related, but smaller rules can end a run too. Before you start, scan your plan for these common tripwires:

The best habit is simple: treat rules like the strategy. Save them, read how drawdown is calculated (equity vs balance), confirm whether max loss is trailing or static, then size trades so the limits never get a vote.

The fee you see on the sales page is only the start. Your real return depends on the path you choose (evaluation or Instant Funding), how many tries it takes you to qualify, and which extras you add at checkout. If you treat the fee like a “one and done” purchase, you can end up surprised when a reset, an add-on, or a platform charge shows up.

A good rule of thumb is to price this like a business expense. Plan for the base fee, then assume there’s a chance you’ll need at least one reset. That mindset keeps you in control, especially when the rules are tight and one mistake can end a run.

GFunded generally sells two ideas: pay less and prove yourself first, or pay more to start funded right away.

With evaluations, pricing commonly scales with account size. In many public summaries, you’ll see ranges like about $95 to $925 for $10K to $200K accounts (plan type and promos can change the exact number). The tradeoff is simple: you’re buying a shot at a funded stage, but you must hit the profit target while staying inside daily and max loss limits.

Instant Funding flips the order. You pay a lot more upfront because you skip the evaluation step. Some published Instant Funding examples show fees like $200 for 5K and $400 for 10K, and it can climb quickly as size increases. In return, you get access to a payout-eligible account right away, often with no profit target.

The part people miss is that Instant Funding can come with a different “tightness” in the rules:

Think of evaluation like a driver’s test and Instant Funding like a toll road. The toll road saves time, but you pay more for the shortcut.

Refund language is where traders get confused fast. Many prop programs advertise “refundable fees,” but the refund is usually tied to performance and timing, not goodwill.

Common patterns traders run into:

Resets are the silent ROI killer. If you break a rule, the easiest way back is often a reset, and the reset fee can be a large chunk of the original cost. Across the prop space, it’s common to see retakes priced close to the first attempt, or only slightly discounted. If your plan’s daily loss limit is tight, that adds up quickly because you can fail from one oversize position, even with a good strategy.

Budget like this instead: assume there’s a real chance you’ll need two attempts. If paying twice would hurt, drop the account size and treat the first run as practice with real stakes.

Even if GFunded is marketed as a one-time fee, your checkout total can rise once you start clicking upgrades. These extras can be useful, but they change your break-even point.

Here are the add-ons that most often inflate the “real” price:

The best way to avoid surprises is boring but effective: read the checkout page and the rules side by side before you pay. If an add-on changes what’s allowed (news windows, holding over weekends, payout timing), treat it like a rule change, not a nice bonus.

If you have questions about document handling during KYC or payout reviews, you can contact GFunded’s Data Protection Officer at privacy@gfunded.com. This is also useful if you want to confirm how long files are kept and what’s required.

Day to day at GFunded often comes down to two things: which platform you’re actually assigned, and the trading conditions on that setup (spreads, commissions, and how stops fill). That’s why reviews can sound inconsistent. One trader gets clean order handling, another fights spread spikes or awkward partial closes.

Treat the platform choice like choosing your workbench. If the tools don’t match how you trade, mistakes show up when you least can afford them (especially with tight daily and max loss limits).

TradeLocker is the simplest of the three for many traders. The interface stays clean and minimal, and it tends to feel comfortable on a phone or tablet. The big day-to-day benefit is speed of action, one-click trading and chart-based order handling can reduce “extra clicks” when price moves quickly. It’s a good fit if you trade discretionary setups and want fewer distractions.

DXTrade usually makes sense if you want a more “broker-style” ticket and broader market coverage. It’s often described as structured, with strong order management, and it can be a better home for traders who like to see margin and position details clearly. If you trade more than just forex (or want that option), DXTrade is often the most flexible.

Match Trader often lands in the middle, modern layout, solid charting feel, and an execution flow that many traders like for active trading. It commonly includes built-in TradingView charts, which is great if your edge depends on clean technical analysis. Some traders also prefer it because it feels quick and app-like across devices.

One practical point: don’t pick based on what looks cool. Pick based on what you do most, fast entries, quick stop edits, partial closes, and closing positions during volatility. Also, many traders show up expecting MetaTrader. MT4 and MT5 are usually not part of the standard experience, so confirm what your plan supports before paying.

Most GFunded plans people discuss are CFD-focused. The typical market list looks like:

That mix works well for traders who like liquid majors, index moves, or crypto volatility. It’s not built for long-term stock investing or options strategies.

On the restrictions side, firms like this usually clamp down on behavior that looks like system abuse. Commonly mentioned examples include arbitrage-style tactics, tick scalping, and ultra-short hold times (sometimes framed as a minimum time in trade). High-frequency patterns and certain news-based approaches can also be restricted unless your plan explicitly allows them.

Rules vary by plan, so keep it simple: confirm the prohibited practices list for your exact account type (evaluation vs instant funding, and any add-ons). Many plans also allow weekend holding, which matters if you swing trade.

Even with a solid platform, conditions can change fast. Spreads can widen around major news, rollover, and thin-liquidity hours. Slippage can show up on market orders and stop-losses when price jumps. None of that is unusual in CFDs, but it hits harder under strict drawdown rules.

Before you risk a real fee, run a quick, boring test that tells you what you need to know:

If the platform feels clunky or the costs crush tight stops, that’s your answer early, before the rules make it expensive.

Payouts are the part everyone cares about, and also where most frustration shows up. With GFunded, you’re not just clicking “withdraw” and waiting. Your payout request triggers a checks process, and your timing and record-keeping can make it smooth or messy.

In plain terms, the usual flow looks like this: you meet the payout requirements (profit, minimum trading days, and any consistency metrics), you submit the request in the dashboard, you complete KYC (if you haven’t already), the firm reviews your account for rule compliance and trade behavior, then the payment is sent. Some traders report payouts landing fast (often around 2 business days), while others report delays when extra checks kick in. The difference is often paperwork, plan rules, or trades that look “off” right before the request.

Start with the profit split, because it shapes your expectations. GFunded splits can be high at the top end (often cited up to 85%), but many paths start lower and improve after milestones, scaling steps, or multiple payouts. In other words, don’t assume you’ll get the headline split on day one. Check your exact plan, and don’t forget that add-ons or account types can change terms.

Next is the rule that quietly changes how you trade: consistency. Many prop firms use a “one day can’t carry the whole period” metric. A common version is a 20% consistency cap, meaning your biggest profit day can’t be more than 20% of your total profit in that payout cycle.

Why it matters: if your strategy relies on occasional big wins (news spikes, breakout days, or heavy scaling), you can hit the profit requirement and still not qualify to withdraw. You might need more smaller green days to “smooth” the stats before the dashboard lets you request.

Finally, pay attention to minimum trading days. Even if you hit the profit number early, you may still need a set number of active days before a payout is allowed. It’s designed to stop one lucky trade from turning into a withdrawal.

Before you build a plan around payouts, confirm three things inside your rules: starting split, how it increases, and whether your plan uses a 20% consistency cap (or similar).

KYC is where a lot of first payouts slow down, mainly because traders wait until the last second. If you want fewer delays, treat KYC like setting up your account, not like a final chore.

Have these items ready before you ever request a withdrawal:

Also keep your own “payout folder.” If there’s any dispute or manual review, having clean records helps you respond in minutes instead of guessing.

Save:

If you have questions about document handling or privacy, there’s a direct contact for that: privacy@gfunded.com. Keep your email simple, ask what files they need, where to upload them, and how long they retain them.

Most payout delays come from predictable problems. The big ones are missing documents, a rule flag, or a last-minute change in trading behavior that looks like someone trying to game the system.

Common causes include:

You can’t control every review, but you can reduce the odds of getting stuck:

Think of the payout like a lease inspection. If everything looks normal and documented, it usually goes quickly. If something looks rushed or inconsistent, it tends to slow down.

GFunded is best understood as a rules-first prop program. You pay a one-time fee to trade a simulated account, then you can earn real payouts if you hit the targets and stay inside strict risk limits. The upside is clear pricing by account size, popular platforms (TradeLocker, DXTrade, Match Trader), and profit splits that can improve over time, but most bad experiences come from rule math, not “bad trades.”

This setup fits disciplined, risk-controlled traders who can respect tight daily and max loss limits, keep position size steady, and avoid big equity spikes (especially on trailing, equity-based drawdown). If you’re patient and consistent, the process can feel straightforward, including withdrawals that some traders report landing within a couple business days once KYC and consistency rules are met.

It’s a poor fit for gamblers, emotional traders, high-frequency scalpers, and anyone who won’t read the terms. One missed detail can end the account, even when your market call was right. Treat risk rules as the product, not the marketing.

Action checklist: confirm eligibility, pick evaluation vs Instant Funding, learn your drawdown math (equity vs balance, trailing vs static), budget for resets and add-ons, demo test spreads and execution on your platform, save dashboard screenshots and trade exports before payout requests.